Open unique

multi-currency

business accounts

Seamlessly send and receive payments from your partners, suppliers, and customers located across the world with a global corporate account.

Which businesses can benefit from multi-currency accounts?

E-commerce

Simplify payments for your international suppliers, partners, and customers.

Import/Export

Leverage favorable FX rates to streamline transactions and minimize risks.

Underserved industries

Enjoy trusted digital banking for licensed gambling businesses worldwide.

Consulting/Marketing

Efficiently manage your revenue and business expenses in diverse currencies.

Travel and hospitality

Manage payments from your customers and partners worldwide with ease.

Cross-border trade

Optimize financial strategies with seamless international transactions

Global reach, local ease

Unlock new opportunities through DAUPHIN PAY’s business SWIFT accounts in multiple currencies, offering seamless cross-border operations and personalized customer support.

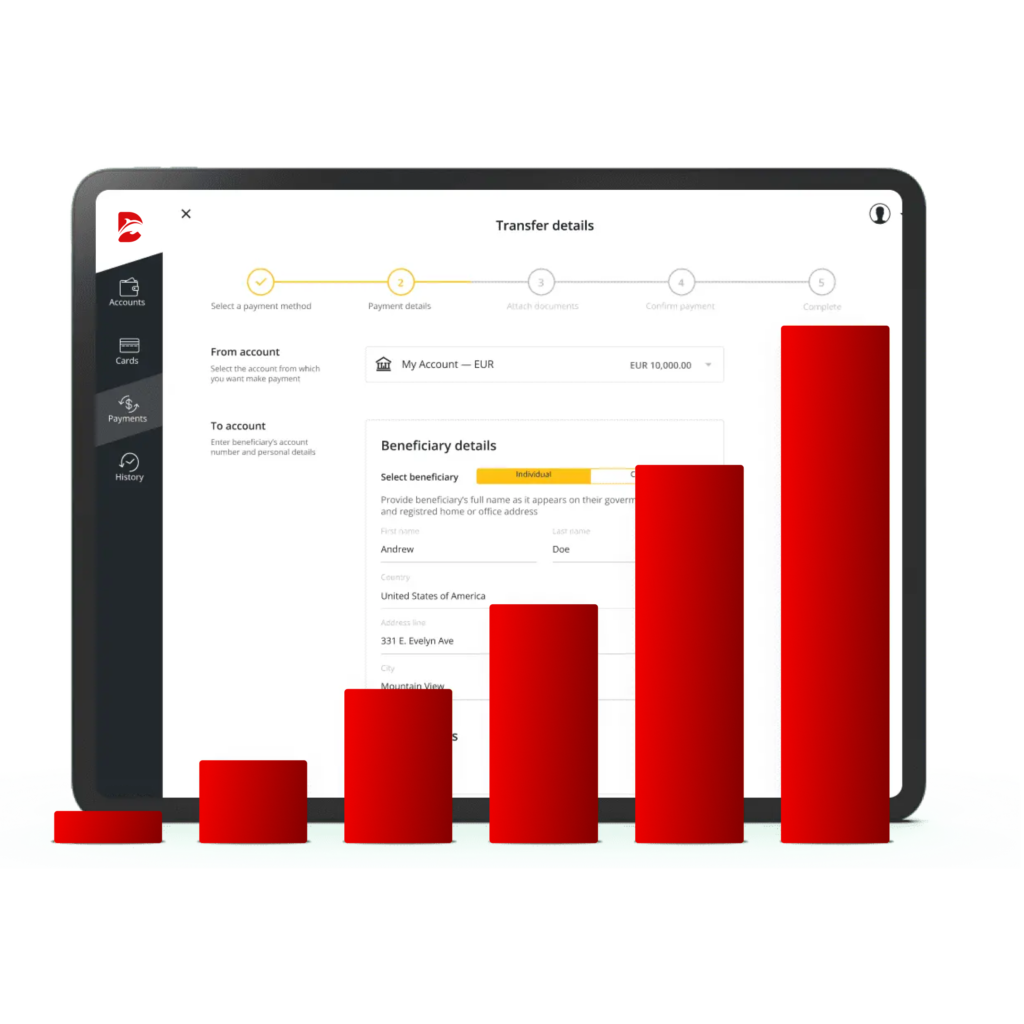

• Open a unique multi-currency business account online

• Manage operations via the Satchel app or web Client office

• Transact in over 20 currencies

• Enjoy the flexibility of global banking from anywhere

• Access live customer support whenever needed

Transact with confidence

Your assets and personal data are protected 24/7 with our advanced security measures, ensuring full regulatory compliance under the oversight of the Bank of Lithuania.

• Regulated by the same authority as traditional banks

• Funds stored in a segregated account at the Bank of Lithuania

• Security features like 3D Secure and 2FA

• Decentralized security protocols for robust personal data protection

Discover currency freedom

Access a versatile range of global currencies, facilitating seamless business transactions worldwide through our extensive network of partner banks and financial institutions.

(AUD)

(EUR)

(MYR)

(SGD)

(BGN)

(HKD)

(MXN)

(SEK)

(CAD)

(HUF)

(NOK)

(CHF)

(CNY)

(INR)

(PHP)

(GBP)

(CZK)

(IDR)

(PLN)

(USD)

(DKK)

(JPY)

(RON)

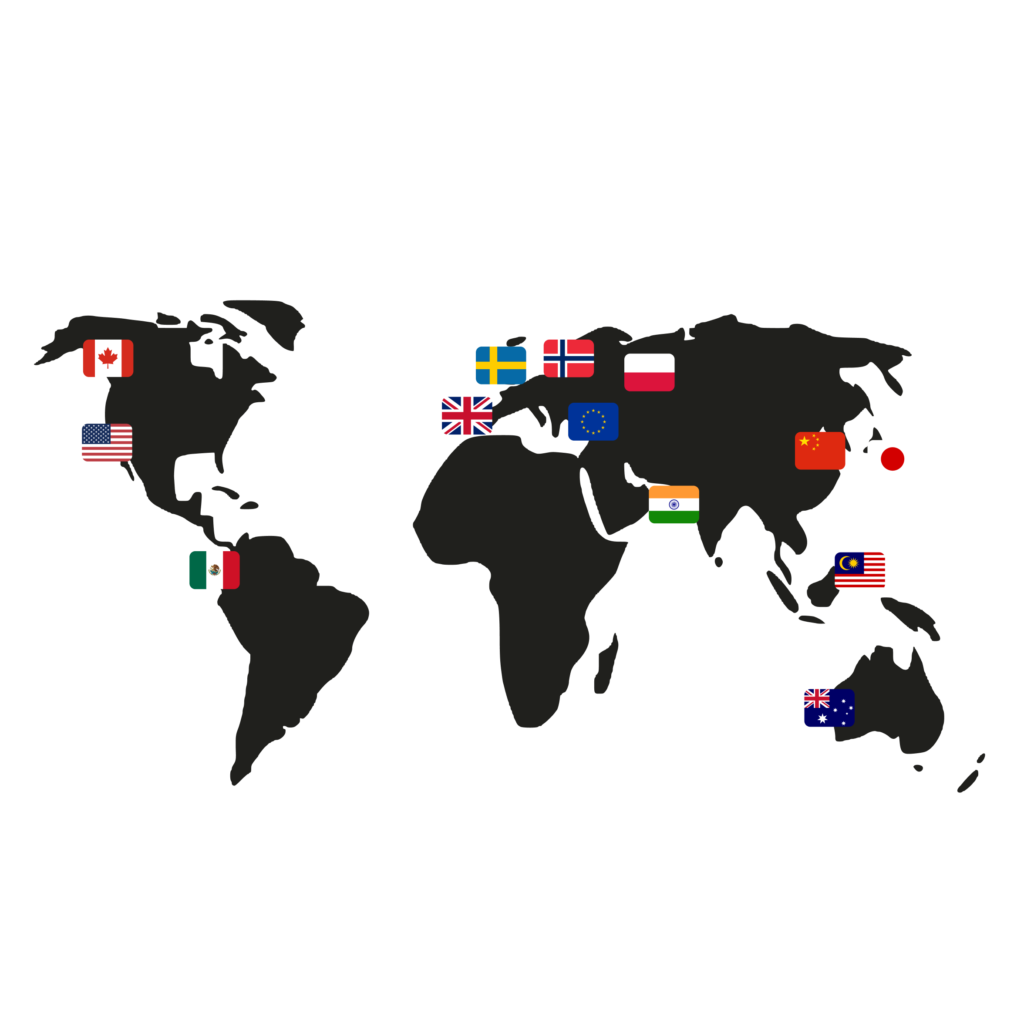

Expand your international reach

• Tap into diverse markets worldwide: Asia, Europe (including the UK), Latin and North America, Australia, and Sub-Saharan Africa.

• Get unparalleled coverage for all your international banking needs spanning over 100 countries globally.

• Leverage our expansive global presence to not only establish a foothold but thrive in new markets, seizing emerging business opportunities with confidence.

Upfront transparency

Our clear fee structure guarantees that you’ll never encounter unexpected charges. Benefit from competitive FX rates, while mitigating potential risks and avoiding losses.

• Transparent fee structure without hidden fees

• Competitive exchange rates

• Simple management and monitoring of FX fees

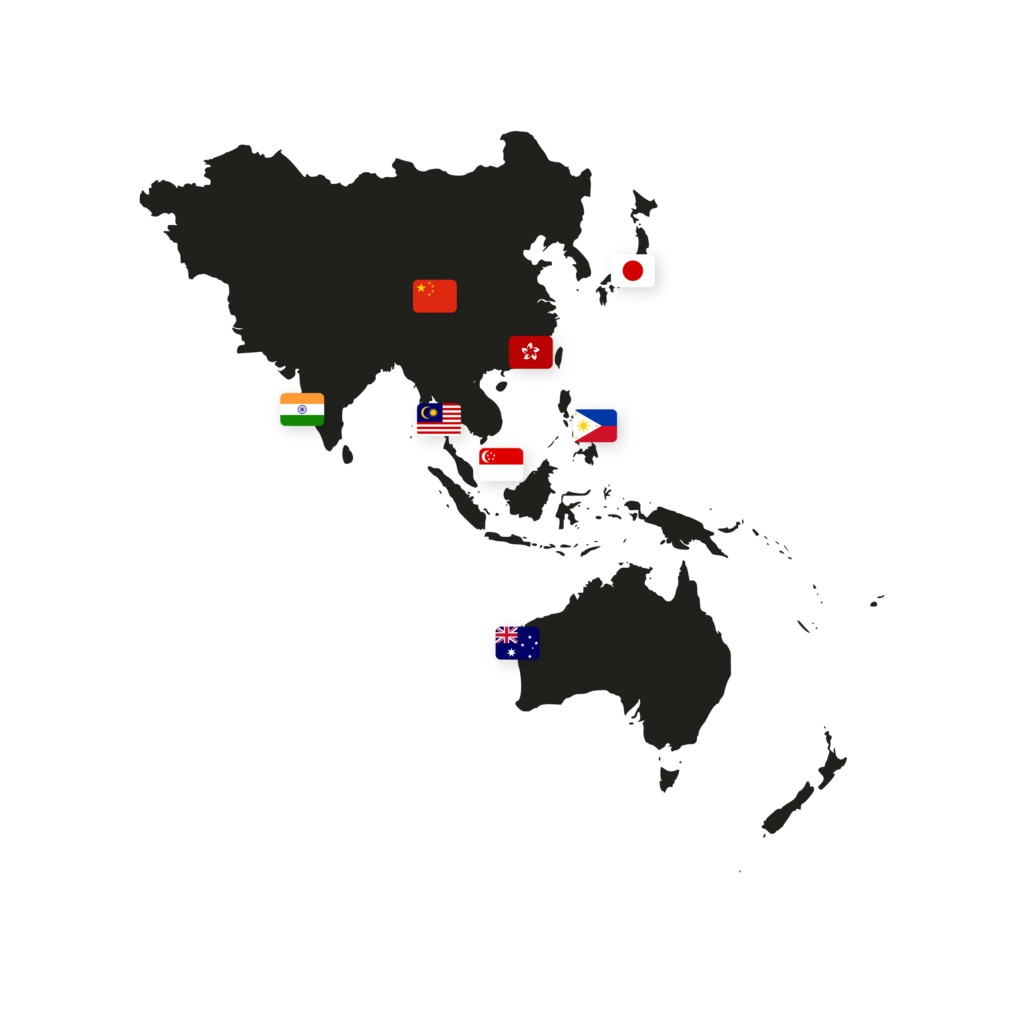

Forge global ties: Asia-Pacific digital banking solutions

Strengthen your global relationships and facilitate seamless international payments in local currencies across dynamic markets such as Hong Kong, Australia, Japan, Singapore, and beyond.

Ready to take your business global?

Our streamlined process makes it simple. From application to activation, get your multi-currency account up and running in 3 steps:

Complete the online application form, attaching necessary corporate documents.

Access your main EUR business account.

Apply online to open an additional SWIFT account in multiple currencies tailored to your needs.

Debit Mastercard cards

Coming soon

FAQ

Multi-currency business accounts allow you to hold, manage, and transact in different currencies. This enables you to streamline global operations and minimize account opening fees, making things simpler and more cost-effective.

Multi-currency business accounts make cross-border transactions easier for companies operating internationally and dealing with various currencies. Similar to a regular bank account, you can deposit, withdraw, send, and receive payments. You can also choose whether to store funds in the original transaction currency or convert them into other available currencies, like USD, HKD, GBP, or CHF, taking advantage of favorable exchange rates.

To apply for DAUPHIN PAY’s unique business SWIFT accounts in multiple currencies, you need a standard set of documents that includes your passport, proof of address, and corporate documents. You can find the full list of required documents here.

Any client with a current business account with DAUPHIN PAY can apply for additional multi-currency accounts. If you’re new to DAUPHIN PAY, you’ll first need to apply for a SEPA account by submitting the online application and completing the KYC procedure. Once your primary SEPA account is operational, or if you already have a SEPA business account with us, you can apply for SWIFT accounts in multiple currencies through your web Client office:

– Log in to your web Client office

– Navigate to the “Accounts” tab

– Click on “New Account”

– Choose the “SWIFT” option

– Complete and submit your application

Our unique SWIFT business accounts offer access to the following currencies:

AUD (Australian Dollar)

BGN (Bulgarian Lev)

CAD (Canadian Dollar)

CHF (Swiss Franc)

CNH (offshore Chinese Yuan)

CZK (Czech Koruna)

DKK (Danish Krone)

EUR (Euro)

GBP (British Pound Sterling)

HKD (Hong Kong Dollar)

HRK (Croatian Kuna)

HUF (Hungarian Forint)

IDR (Indonesian Rupiah)

INR (Indian Rupee)

JPY (Japanese Yen)

MXN (Mexican Peso)

MYR (Malaysian Ringgit)

NOK (Norwegian Krone)

PHP (Philippine Peso)

PLN (Polish Zloty)

RON (Romanian Leu)

SEK (Swedish Krona)

SGD (Singapore Dollar)

USD(United States Dollar)

Get in touch with DAUPHIN PAY

Submit your request and our specialists will get back to you shortly with the most suitable solution