One-stop solution

for money

management

• Open account remotely in 10 minutes

• Unique European IBAN

• Physical and virtual Mastercard for your daily needs

• Personalized pricing plans, no hidden fees

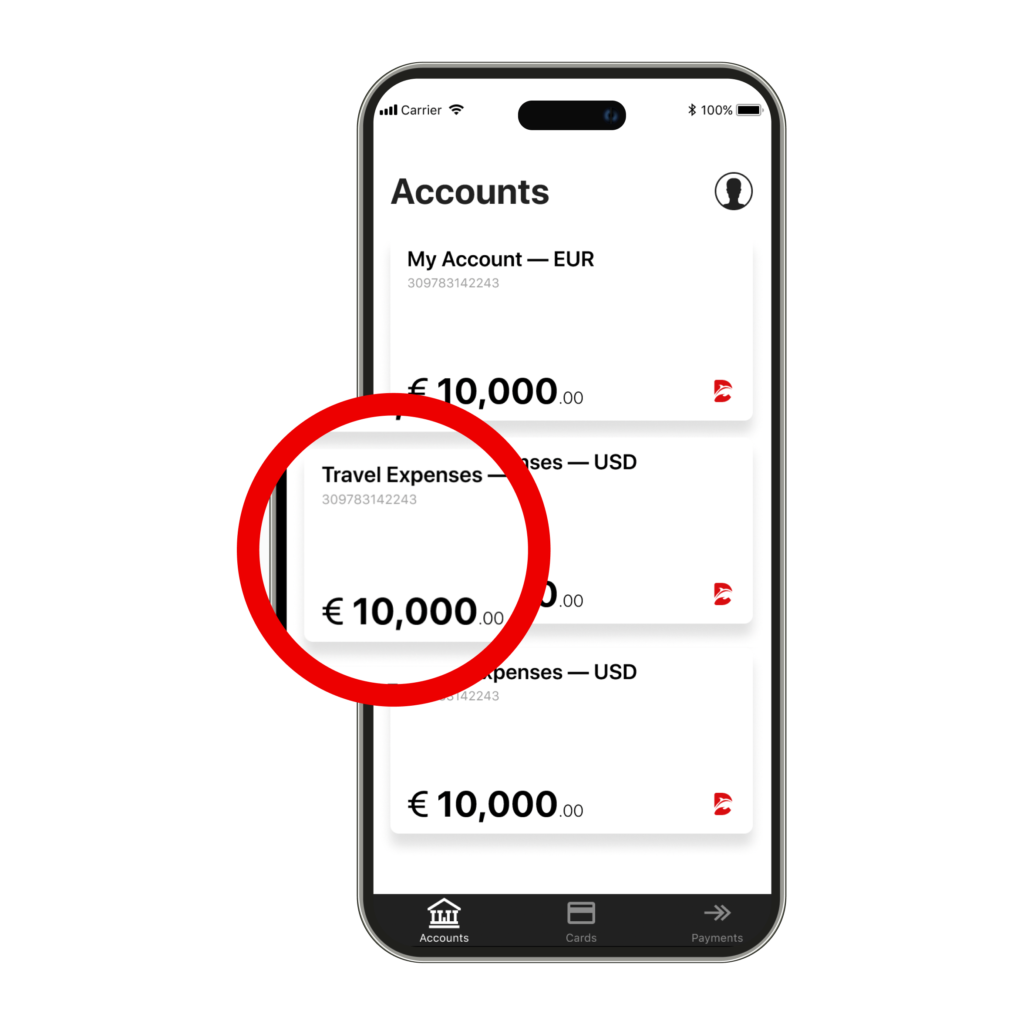

Solution that fits your lifestyle

Works worldwide

Pay and withdraw money at any location around the world

Fast and convenient operations

Receive and send money transfers

across the globe, hassle free

Great alternative to your local bank

Enjoy fully-digital money management with 24/7 access to your funds

Remote account opening

Open your account and get a unique European IBAN in just a few simple steps, from wherever you are. All you need is two personal documents (Passport/ID card, Proof of Address) and 10 minutes of your time

Payment card that covers your needs

• Physical and virtual cards for any purchases

• Contactless payments

• No hidden fees

• ATM withdrawals worldwide

• Personalized pricing plans

Safe & Sound

We adhere to highest EMI security standards

to keep your money and personal data safe.

• Client money is stored on a segregated account

with the National Bank of Lithuania

• Funds protection using 3D secure and 2FA

Choose the business account that suits you best

| European EU residents | International non-EU residents | |

|---|---|---|

| Monthly maintenance fee | € 1 | € 35 |

| Additional account opening (sub-account) | € 50 | € 150 |

| Instant transfers between DAUPHIN PAY users | Free | Free |

| SEPA transfers (incoming) | Free | Free |

| SEPA transfers (outgoing) | ||

| SWIFT transfers (incoming/outgoing) | ||

| Mastercard physical card | ||

| Virtual cards | ||

| Cash withdrawals across the globe | ||

| Mobile banking APP | ||

| In-app live chat support | ||

| All your money is protected by the Bank of Lithuania | 100% Secure | 100% Secure |

FAQ

A personal account is a financial account tailored for personal finances management.

Typically used for everyday financial tasks, such as making payments, transferring funds, tracking expenses, and receiving salary deposits, these accounts offer similar functionalities as standard bank accounts.

Private accounts provide a user-friendly interface that simplifies financial operations, making it convenient for individuals to manage their money effectively.

DAUPHIN PAY offers personal and freelancer accounts with remote account opening.

A personal account is a one-stop solution for simple money management and comes with a unique European SEPA IBAN and virtual and physical Mastercard payment cards for secure everyday purchases.

A freelancer account allows you to manage your invoices and payments as an entrepreneur in a smart and efficient way.

Absolutely! If you’re 18 years of age or older and a non-EU/EEA resident with a valid international passport, you have the right to open a European payment account. As a digital-only banking provider, we’ve streamlined online account opening, making it accessible to individuals coming from outside the EU/EEA.

You don’t need to be a resident of an EU/EEA country; a utility bill from your home country is all that’s required. You can easily open your account remotely from your home country.

At DAUPHIN PAY, we have no restrictions based on our clients’ country of origin or residence. However, please be aware of our list of blacklisted jurisdictions.

Below you will find the full list of documents needed to open a EU personal account online at DAUPHIN PAY:

1. Your passport or national ID.

2. Proof of address or bank statement translated into English.

Please note that EU citizens can use their ID card or international passport to complete the application. Non-EU citizens must use the international passport option. EU/EEA residency is not obligatory, but we do require a recent utility bill not older than 90 days with your name and address in your home country as proof of residency.

Opening a European IBAN account online with DAUPHIN PAY is a straightforward process. You just need to follow these steps:

Step 1: Submit your online application

– Begin by applying online, filling out the required information: first name, last name, email, and phone number. Complete the verification process, which includes submitting scans of your passport or ID card and a facial scan.

– Fill out a brief questionnaire and attach either a utility bill dated within the last 3 months or a bank statement translated into English. Please note that a utility bill with your address in your home country suffices, and EU/EEA residency is not required.

– Set up your password by following the link provided in the welcome email. In this email, you’ll also find a link to download the DAUPHIN PAY mobile app, which will allow you to access your Client Office using your email address and the password you’ve created.

Step 2: Application processing

Our team will remotely process your application within 1-3 business days. If any additional questions or requirements arise, our Customer Support team will get in touch with you.

Step 3: Welcome aboard!

Once your application is approved, you are all set to embark on your financial journey with DAUPHIN PAY!

While using your personal account for business transactions might be tempting, we strongly discourage it due to potential legal complexities. A crucial step in launching a successful business is opening a dedicated corporate account. This step is vital for maintaining precise financial records and efficiently managing your business’s cash flow.

At DAUPHIN PAY, the process of business account opening is straightforward and can be completed online, eliminating the need for a physical branch visit. Our European business accounts are accessible to companies worldwide, regardless of their registration status or physical presence in the European Economic Area (EEA) or Switzerland. Before submitting your online application for a corporate account, please check our list of blacklisted countries.

Get in touch with DAUPHIN PAY

Submit your request and our specialists will get back to you shortly with the most suitable solution