Ultimate account for your business

Get a unique European IBAN online and cover all business needs with DAUPHIN PAY payment cards.

Solutions for corporate needs

Safe and secure storage

Deposit funds for future use with additional layers of protection using 3D secure and 2FA

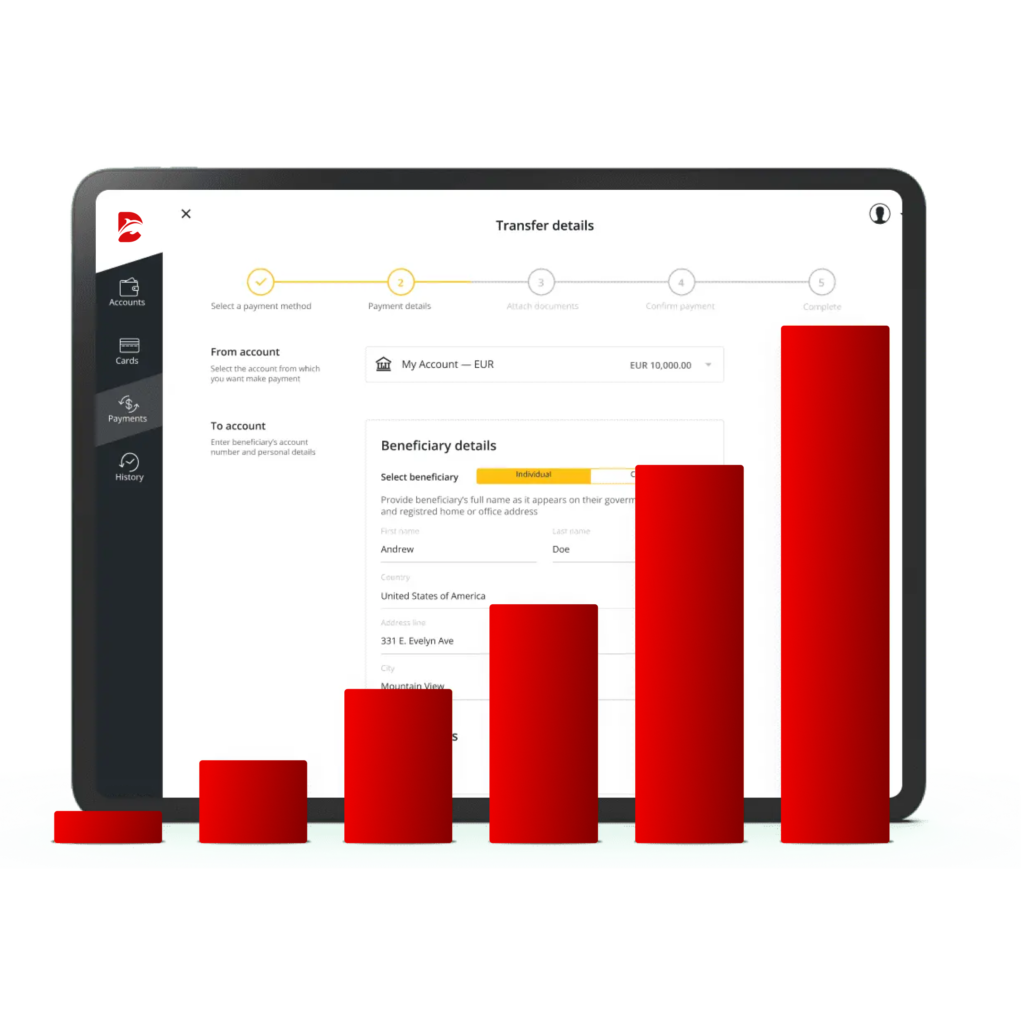

Transact with ease

Manage your daily transactions with clients, partners, and suppliers

Invest smartly

Invest your dividends or extra earnings to increase corporate capital

Simplified accounting

Keep track of your account balance and transaction history for efficient and transparent bookkeeping

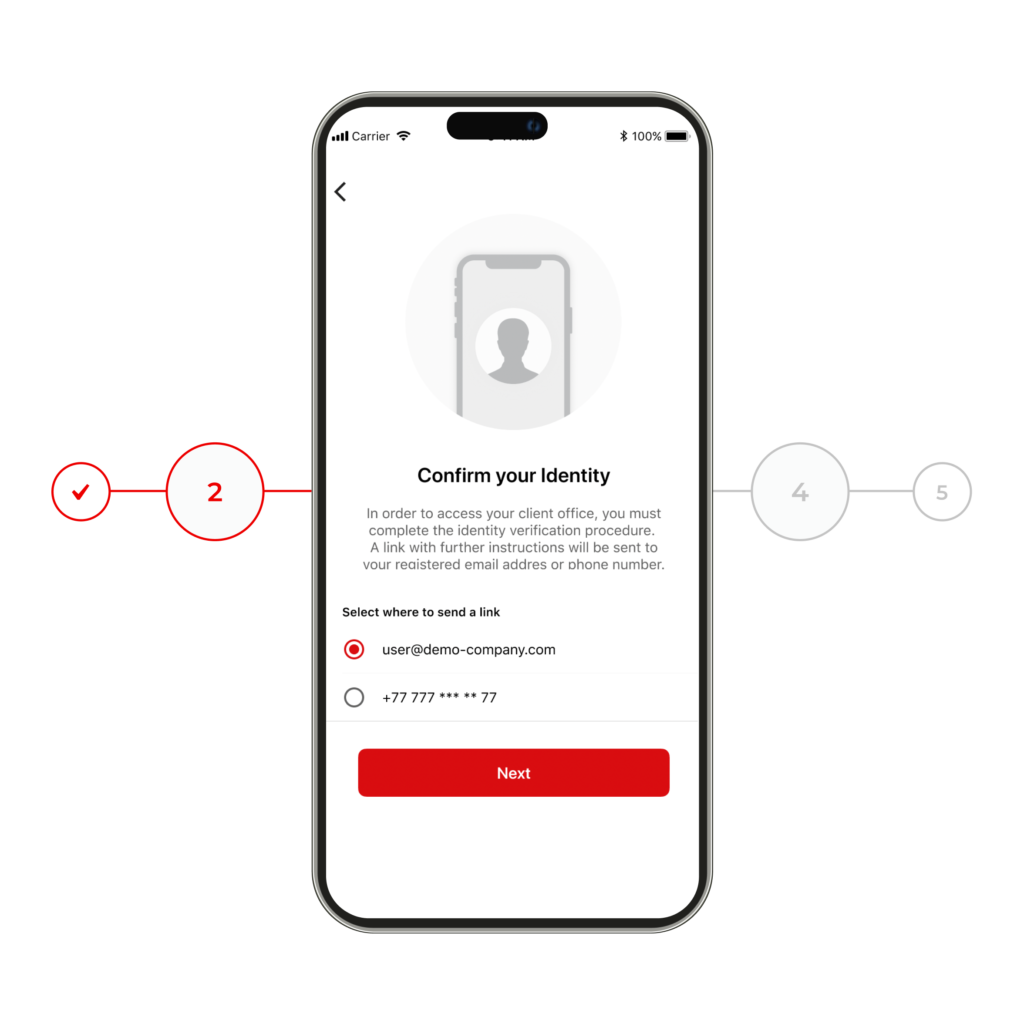

Remote account opening

• Unique European IBAN

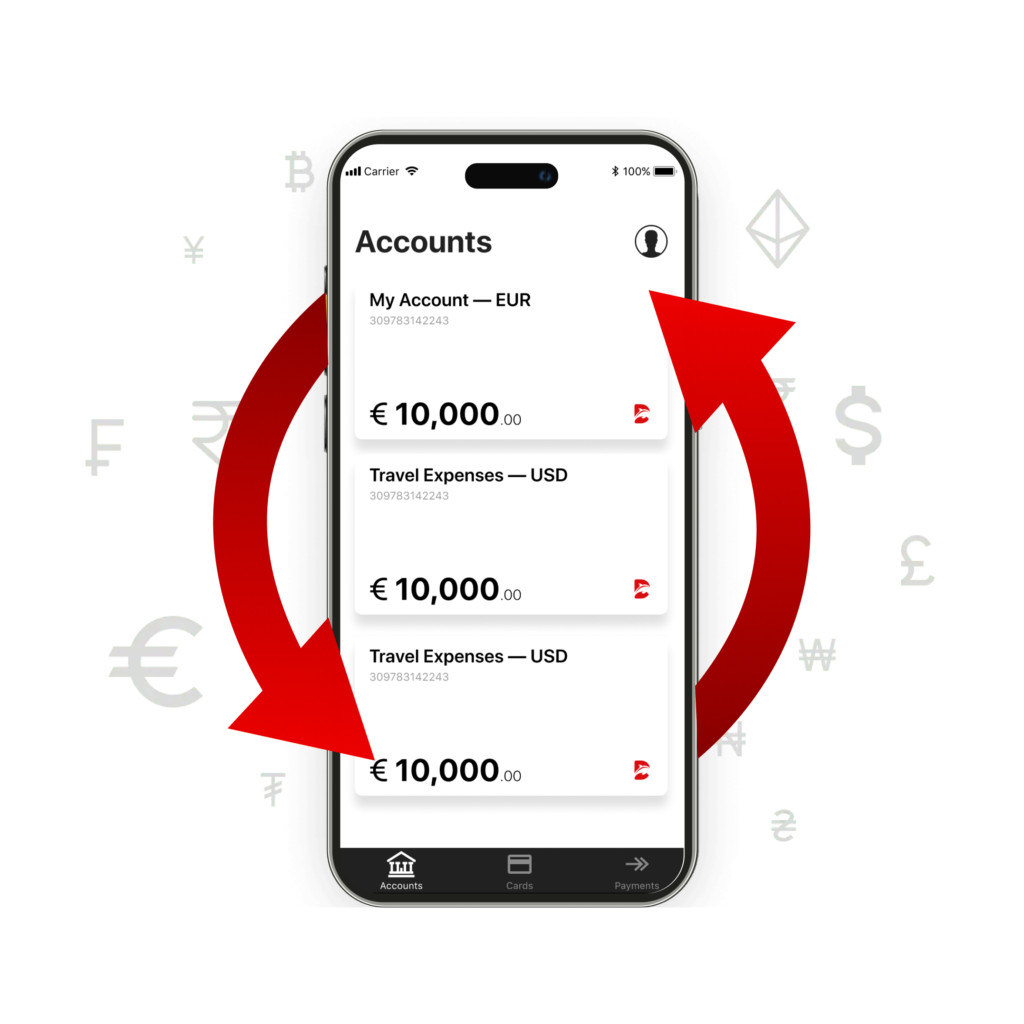

• SWIFT and SEPA transactions in 38 currencies

• Simple online application form

• Personalised customer support

• Segregated account protected by the National Bank of Lithuania, with an added layer of protection thanks to 3D Secure and 2FA

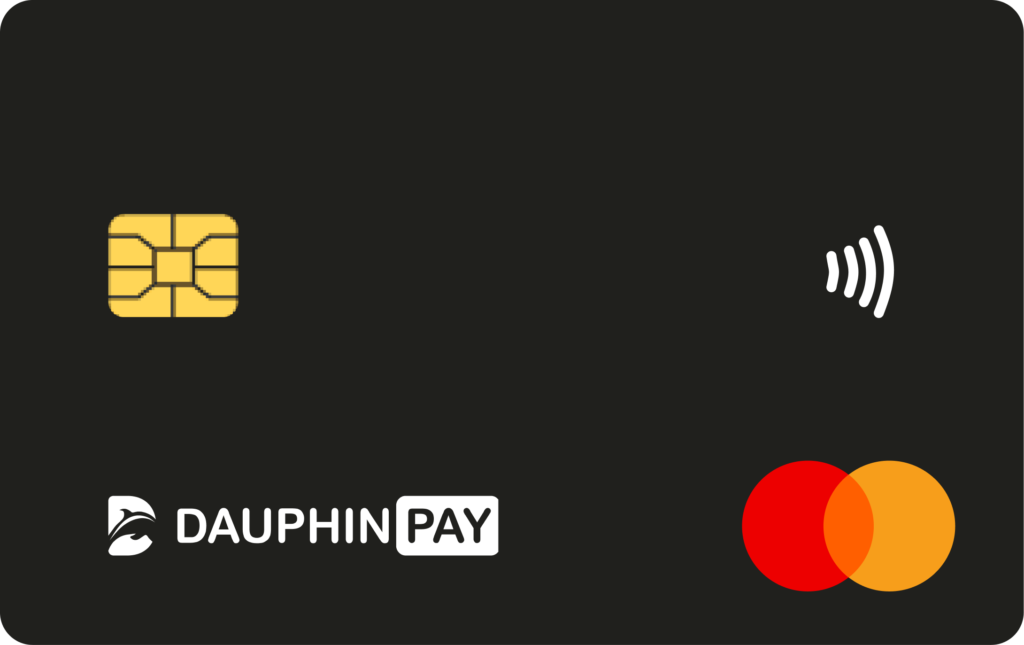

Payment cards for your business needs

• Physical and virtual cards for any purchases

• ATM withdrawals worldwide

• Tailor-made pricing

Multiple currencies for cross-border payments

Send and receive money around the world in 38 currencies with a multi-currency IBAN linked to your single account.

Payroll program

• Manage salary payouts and corporate expenses

• Issue from 3 to 100 cards

• Make transfers directly from your Client office or the DAUPHIN PAY app

Debit Mastercard cards

Coming soon

Link it to several accounts in different currencies

Pay in the currency of the transaction

Avoid currency exchange fees

Direct access to your funds 24/7

Choose the business account that suits you best

| European EU residents | International non-EU residents | |

|---|---|---|

| Monthly maintenance fee | € 35 | € 50 |

| Additional account opening (sub-account) | € 50 | € 150 |

| Instant transfers between DAUPHIN PAY users | Free | Free |

| SEPA transfers (incoming) | Free | Free |

| SEPA transfers (outgoing) | ||

| SEPA Instant transfers (outgoing) | ||

| SEPA Instant transfers (incoming) | ||

| SWIFT transfers (incoming/outgoing) | ||

| Mastercard physical card | ||

| Virtual cards | ||

| Cash withdrawals across the globe | ||

| Mobile banking APP | ||

| In-app live chat support | ||

| All your money is protected by the Bank of Lithuania | 100% Secure | 100% Secure |

FAQ

A business account is opened in the name of the company and is used for corporate transactions with suppliers, partners and customers, as well as purchases, bill payments etc. It also has a variety of additional uses, such as reporting, audit, salary payout and bookkeeping. Such accounts operate similarly to personal ones, however, business account holders can access services that are unavailable to individual users, such as:

– Foreign currency transactions

– Credit checks

– Payroll

Today, you can open a business account online, without the need to visit a bank branch and provide heaps of documentation.

DAUPHIN PAY Business accounts are available worldwide. Since account opening applications are submitted and processed online, there are no geographic restrictions. Companies registered in any region other than blacklisted countries can open a DAUPHIN PAY account with a European IBAN. We recommend that you check the latest list of restricted jurisdictions before applying.

Businesses registered in Europe, including the UK and Switzerland, as well as Latin America, North America, Asia Pacific, South and Southeast Asia, the Middle East, Africa, Oceania and the Caribbean, are all eligible to apply for opening a DAUPHIN PAY Business account.

To open a business account with DAUPHIN PAY, you will need to provide the following list of documents:

1. Online application form.

2. Copy of the business owner’s passport or ID (only for citizens or residents of the EU or the EEA).

3. Proof of address.

4. A detailed business description.

5. Corporate documents.

6. Supporting documents on clients/suppliers.

7. Documents with supporting information about initial funding.

8. Verification through the Ondato solution.

More information can be found here.

At DAUPHIN PAY, we offer business accounts. A business account is opened remotely and allows you to:

– Get a unique European IBAN;

– Transact in 38 currencies through SWIFT and SEPA;

– Enjoy personalized customer support;

– Cover all business expenses with DAUPHIN PAY payment cards.

To open a business account with DAUPHIN PAY, you will be charged an account opening fee, which may vary depending on your company’s jurisdiction, the residence and nationality of the owners, and the risk type of your business. The commission for opening a DAUPHIN PAY Business account starts from €4.00; you can find more details regarding the fees here.

On average, most financial institutions require an initial deposit of between €5.00 and €1,000. However, at DAUPHIN PAY, we do not require an initial deposit and only charge an account opening fee if your application is approved.

Get in touch with DAUPHIN PAY

Submit your request and our specialists will get back to you shortly with the most suitable solution